Stewardship

Stewardship comprises the responsible allocation and active management of assets with the aim of creating sustainable, long-term value for clients. This includes monitoring and active dialogue with the portfolio companies, the targeted exercise of shareholders' rights and the exchange with other asset managers as permitted by law.

The DVFA* Stewardship Guidelines for Asset Managers require:

1. Stewardship declaration (mandatory)

2. Continuous monitoring of portfolio companies

3. Constructive dialogue with the portfolio companies

4. Escalation process when a dialogue fails

5. Informed and responsible exercise of voting rights

6. Publication of voting behavior

7. Assessing collective engagements

8. Dealing with conflicts of interest

9. Reporting

* German Association for Financial Analysis and Asset Management

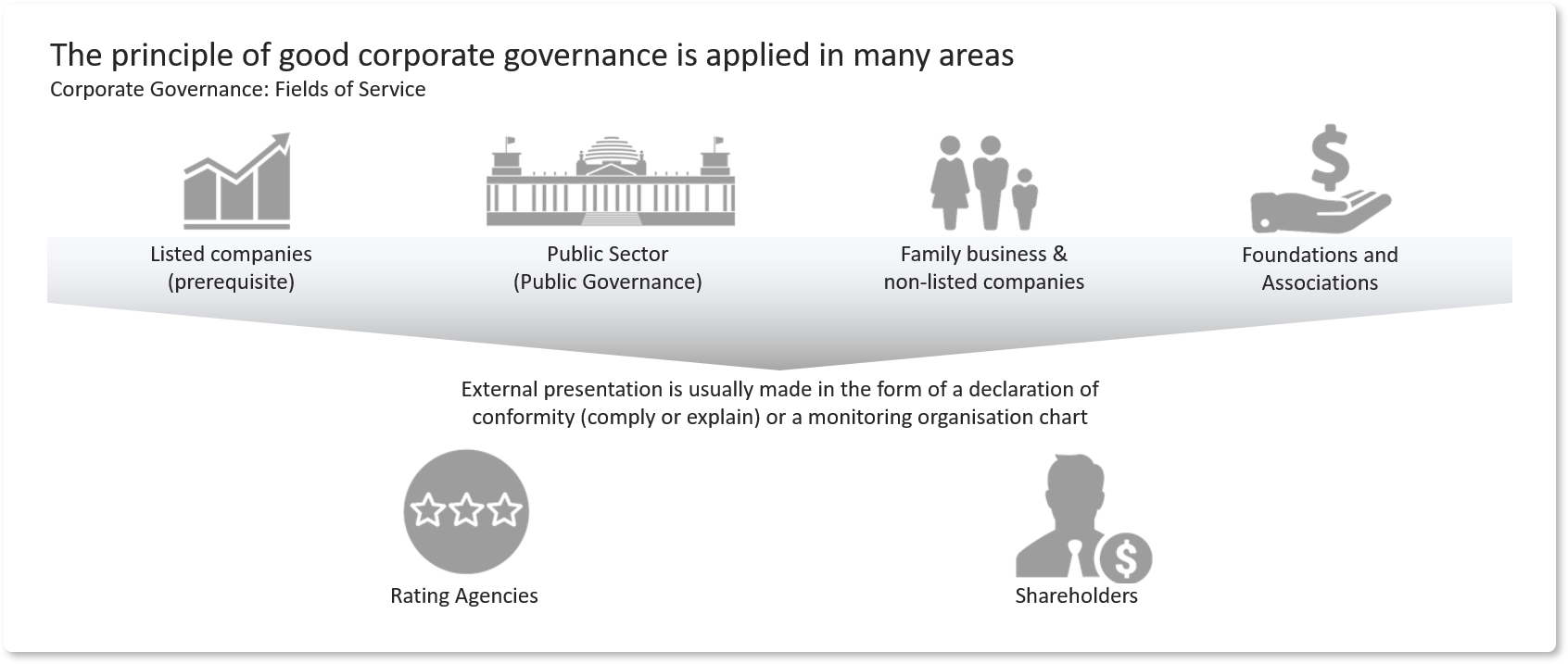

Corporate Governance

The Organisation for Economic Co-operation and Development (OECD) defines the purpose of corporate governance as "to contribute to the creation of an environment of trust, transparency and accountability necessary to promote long-term investment, financial stability and business integrity, thereby enabling stronger growth and a more inclusive society".

Updating governance, keeping it there and marketing it.

Advantages of good corporate governance

Positive influence on raising capital

Value-enhancing influence on the company

Reduction of entrepreneurial risk

Reference framework for decision-makers, investors, banks, stakeholders, etc.

Flexible design

Positive external image

Principles of good Corporate Governance

Composition of the Supervisory Board

Efficiency of the Supervisory Board

Capital Measures

Statutes & Articles of Association

Transparency

Chartered Accountant

Remuneration

Mergers and Acquesitions

Sport is of public interest. In contrast to private sector companies, misconduct in the sports sector reveals itself as if magnified through a burning glass.

Good governance in sports is essential for creating trust, transparency and integrity. Therefore, it is a prerequisite for the financing, stability and further development of the individual sports clubs and associations. Sports governance should ensure the independence of the individual clubs and associations, as well as their decision-makers.

In order to promote the aforementioned, we actively participated in the founding of the Sports Governance Association and actively support it.

The goal of the association is to foster responsible and sustainable sports management. The proactive approach to governance issues is intended to strengthen the trust of fans, spectators, investors, sponsors and lenders on the one hand, as well as athletes, clubs and associations on the other hand.

This is done through events and conferences, training measures, scientific publications and active networking.

With the help of our cooperation partner Sports Governance Unit (“SGU”) from Zurich, we offer a range of services relating to governance and sustainability in sport. These include:

- SGU rating - analysis and evaluation of clubs’ and associations’ governance, risk management, compliance and corporate social responsibility

- Efficiency audits - external or internal assessment of the supervisory bodies

- Education and training in the areas of sports governance and sustainability

- Support in the creation of codes and regulations

- Mediation

- Stakeholder dialogue with sponsors, investors, lenders, associations, politicians and media representatives